If you missed our 3D Roundtable on Supply Chain and 3D Printing, you can watch it here.

Supply chain issues have been front and center for manufacturers for the past 12 to 18 months as increased demand has collided with reduced material supply, restricted manufacturing, capacity, labor shortages issues, and both cost and timing. The result has caused most enterprises to reevaluate their supply chains, including their sourcing strategies, inventory policies, and even merger and acquisition plans.

3DEO recently gathered a virtual panel of experts to discuss the global supply chain and how 3D printing can impact companies’ efficiencies, logistics and revenue.

Our objective was to bring together four thought leaders with manufacturing and supply chain expertise to discuss the importance of an efficient supply chain operation, the links between the past year’s global supply chain crisis and how onshore can help alleviate backlog and resolve supply chain constraints, 3D printing’s role in online revenue for companies affected by supply chain, and list key optimization tips to incorporate 3D printing and onshore and into the supply chain.

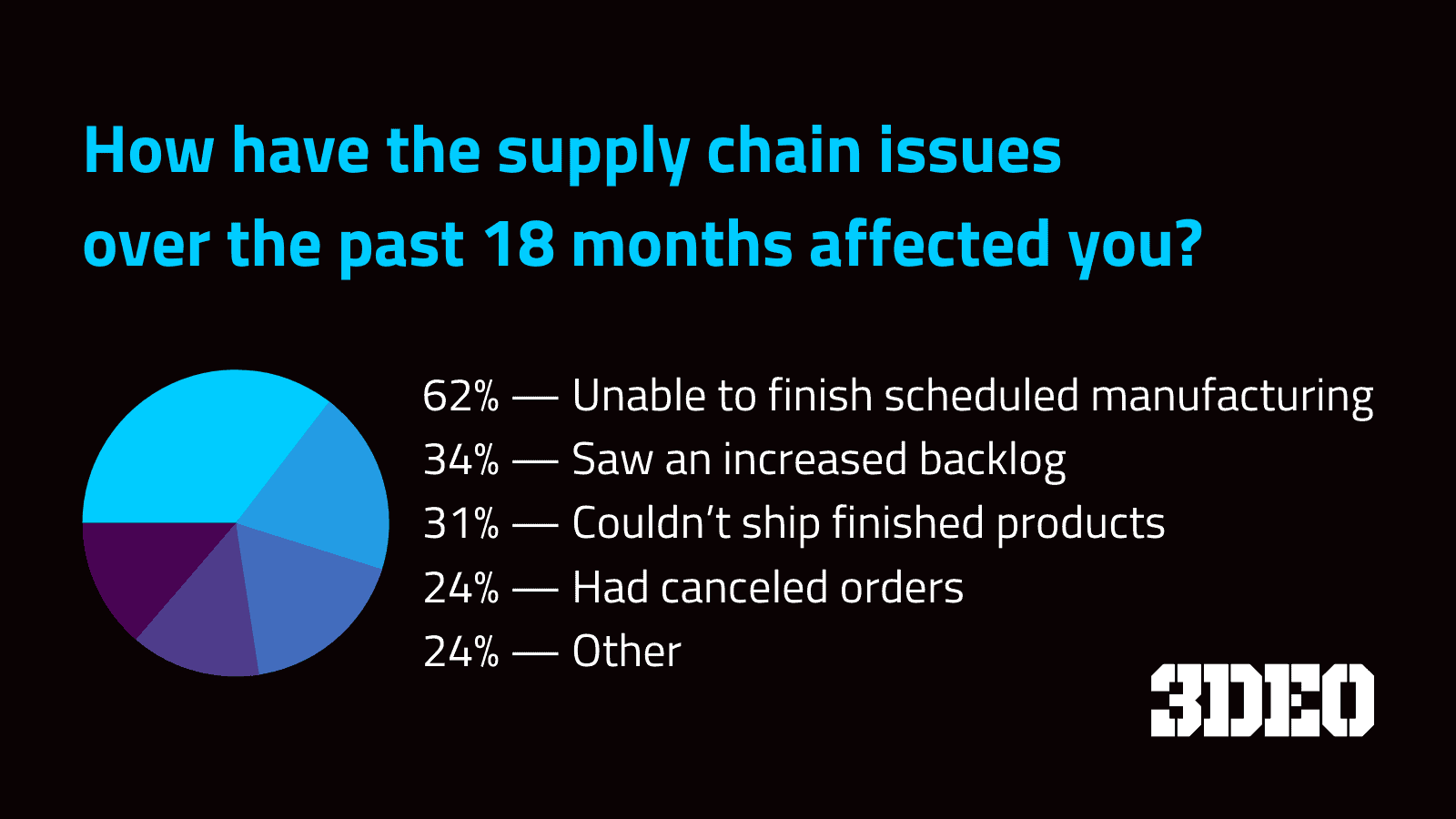

We started with a poll of our 51 participants, allowing them to select multiple answers to the following question:

How have the supply chain issues over the past 18 months affected you?

Here were the results:

62% — Unable to finish scheduled manufacturing

34% — Saw an increased backlog

31% — Couldn’t ship finished products

24% — Had canceled orders

24% — Other

Here’s the questions we asked our roundtable experts, with some of the top takeaways from each.

1. What’s your opinion on the global supply chain today?

Mark Christensen, Senior Vice President of Supply Chain, Christensen Arms: We have so many things that can impact our supply chains and really understanding how do we respond to those and how do we become resilient is really where we need to focus this year.

Phillip S. Coles, Decision & Technology Analytics, Lehigh University: We had a pandemic that we didn’t allow people to go to work, so we couldn’t make anything. And then the government started passing out money, so you could buy stuff, so we had the classic increased demand with a reduced supply.

2. What amount of safety stock is correct? And, what’s the right way to incorporate demand, variability, and supply lead time to define appropriate inventory?

Mark Christensen: Focus on safety stock. You need to look at your past consumption, what you think their future looks like, and then really dial it in on small, frequent deliveries.

Phillip S. Coles: Inventory is like insurance. We pay a lot for insurance for our car if we have a lot of accidents and speeding tickets. So how do you lower your insurance? You get rid of the speeding tickets and you don’t have accidents. You need to do the same thing; eliminate those problems that are happening in your supply chain. And then the main thing you have to do is reduce lot size. So it’s at a lot of different levels that you have to attack, but we can calculate what safety stock we need for normal operation very easily. It’s that risk management stage that makes it more complicated.

3. There’s a big move for supply chains right now to reach shore supply in many industries; but what’s the right approach? Offshore, nearshore, onshore? And how do you evaluate options that may incur perhaps an even higher piece price?

Mark Christensen: When impacts happen, the corporations need to evaluate, what is our strategy? Is it to satisfy customer need? Is it to be the lowest cost? I challenge all of my buyers and those people that work in my organization, what is that total cost of ownership? What’s the cost? Is it cheaper, but you have to build in pricing for the delays? How much extra inventory will I need to keep on hand to be able to accommodate for those things? And there’s a cost to carry an inventory. Many people put that right around 30%. What did it cost you on holding that inventory? And if you’re having to carry three times as much to accommodate those stock outs, that may happen because of freight or because of shortages from overseas. So, I see a lot of organizations really looking internally and saying, do we buy the equipment and do it in house, which is what we’re doing here at Christensen Arms, or do we find partners that are close that can do that low quantity, more frequent delivery and consistency?

Phillip S. Coles: The other thing to think about when you’re getting stuff from far away, like southeast Asia, is they’re on boats, and we think of it as shipping, but they’re also warehouses that are very costly. Plus bad things happen between here and there. And the further away, the more chance of bad things happening. If I can make it locally, if I can make it by tomorrow, that means I only have to see into the future until tomorrow. It’s not too hard to look into the future tomorrow.

4. What do you see as the benefits of reducing lot sizes and shortening the supply chain with companies considering leaving traditional methods to introduce additive manufacturing?

Dayton Horvath, Director of Emerging Technology, Association for Manufacturing Technology: For the brave companies that are willing to leave other methods for additive, my hat off to you. You might go back and forth a few times before you get it landed, because 3D printing is not simple. Why would we buy a 3D printer? Well, it’s not quite that straightforward from a logic standpoint. And that’s where I’d say the one really valuable part that many of the 3D printing companies have started pushing for is the same machine you’re prototyping on, you can now do short run production on. That’s been the one part of 3D printing that people are still used to, that 3D printing is prototyping. I do my form, I do my fit, and then I move on to my normal methods; not the case anymore in many opportunities.

5. Can you tell us a bit about the considerations for companies to make 3D printing more attractive from a cost and time perspective?

Matt Petros, Co-Founder & CEO, 3DEO: We’ve been blessed to have been developing a technology that over time has gotten to the level of repeatability and consistency that manufacturing really needs, and I think that it’s actually a pretty straightforward thing to say. Our customers are our salt of the earth people that produce physical products, and it’s very straightforward that if you cannot deliver quality on time at a cost that that is competitive with what they are used to, then you are not going to be sitting at the table.

There are customers that we have had, especially with these COVID supply chain issues that had several million dollars of inventory sitting on a dock, just waiting on a couple parts. And those parts were things that they never even thought about for the last several years. And to get them spun up with a different supplier would’ve been, a nightmare; new tooling costs, several months of development, even though they already knew how to make the part. These customers are finding with 3D that you can get first articles in a matter of a couple weeks in most cases and some version of a production delivery in the next month or so.

6. A lot of people still think of 3D printing as just for prototypes, but are you feeling momentum that companies are seeing the desire to move into high volume 3D printing?

Matt Petros: Absolutely. 3DEO is shipping very regularly orders of hundreds of thousands of metal parts. This is not typical of 3D printing, whether it’s metal or otherwise, you’re talking about prototypes or one-offs, and here we are delivering over a hundred thousand pieces a year consistently to several customers. And I think that’s just the beginning for us.

7. What are the recent statistics on the rise of 3D printing?

Dayton Horvath: My favorite leading indicator is venture capital investment because the amounts are usually disclosed and we can see what technology categories or material classes that those technology categories work with, where that money’s really flowing. Although not all of it’s disclosed, that just gives us a nice floor to think about. So when I say that the 3D printing industry has seen a 28% growth in venture capital investment every year since 2017, with 2021 being of 1.2 billion, in an industry that some say a market size globally of printer sales services, meeting parts made, and material sales is only 10 to 12 billion. That’s crazy to think that there’s more than 10% coming in annually, just in new investment. Where is this explosion of growth going to go in the next three to five years? And so that’s the excitement that I see day in, day out and try to keep track of, because it’s turned into a full-time job.

8. Are there any supply chain issues for additive manufacturing such as, you know, starting costs of additive manufacturing, equipment, parts, etc.?

Matt Petros: Absolutely. I like to think that we’re bulletproof, but the reality is that we live amongst everybody else in these supply chains and we’re dependent on machine tool suppliers, powder, and lot of the things that this panel has been saying are tactics that we take to try to mitigate that risk. So absolutely 3D printing suppliers are not immune from supply chain issues.

9. What’s your one sentence “hot take” on how 3D printing can affect the supply chain?

Mark Christensen: Every company should evaluate 3D printing to see if it can help them solve some of those supply chain challenges, either long lean times, hard to get products, launching a new product line. They want to be able to get those products out there earlier and be able to be more competitive in the marketplace. I would just suggest everybody to take a look at how 3D printing can really help solve some of those key supply chain problems that are plaguing us today.

3DEO is the world’s highest volume manufacturer of 3D printed precision, metal components made with our patented metal 3D printing technology and digital manufacturing platform. Our additive manufacturing expertise is in complex geometries and designs for small, less than four cubic inch components.

At 3DEO we help our customers avoid supply chain issues through frequent deliveries from our us based factory with no minimum order quantities. With our unique capabilities, we have enabled our customers to launch products faster, eliminate backlog, and bring more technically advanced products to life.